How to Increase the Value of Your Short-Term Rental Business

In this article you’ll learn proactive steps you can take today to elevate your business for tomorrow.

Whether you are looking for guidance with industry best practices or may be interested in selling your short-term rental business at some point in the future, implementing these items will guide your company to becoming a market leader.

A company’s value is determined by a combination of quantitative data (EBITDA, Revenues, Unit Count, etc) and qualitative data (Brand, Culture, Reviews, etc). Below we will touch on incremental changes that can have exponential effects. Measuring and tracking key performance indicators (KPIs), optimizing operations, and assembling consistent financial reports are paramount for maximizing the value of a short-term rental business.

Company Trends

It seems like everything is about data nowadays. However, data means nothing if you don’t know how to read it. The saying “garbage in, garbage out” is also true if you are not consistent in your reporting and tracking. By tracking these metrics and KPIs below, you can identify areas where you can improve your business and ultimately increase its value.

Unit Count

Managed inventory is a major data point. Since unit count fluctuates for short-term rental management companies, tracking these trends can quickly identify growth areas as well as potential concerns (i.e., Does your company have a “leaky bucket”?).

A simple way to analyze unit count data is to keep a monthly units gained & lost spreadsheet. Always note the source of new units AND the reason for each unit churned. Reasons for homeowner churn allows the company to spot issues and implement solutions fast. While it might seem obvious, even some of the largest players in the industry struggle to track their units gained & lost.

>>> The average annual churn rate is 8-10%. Reach out if you’d like a template spreadsheet

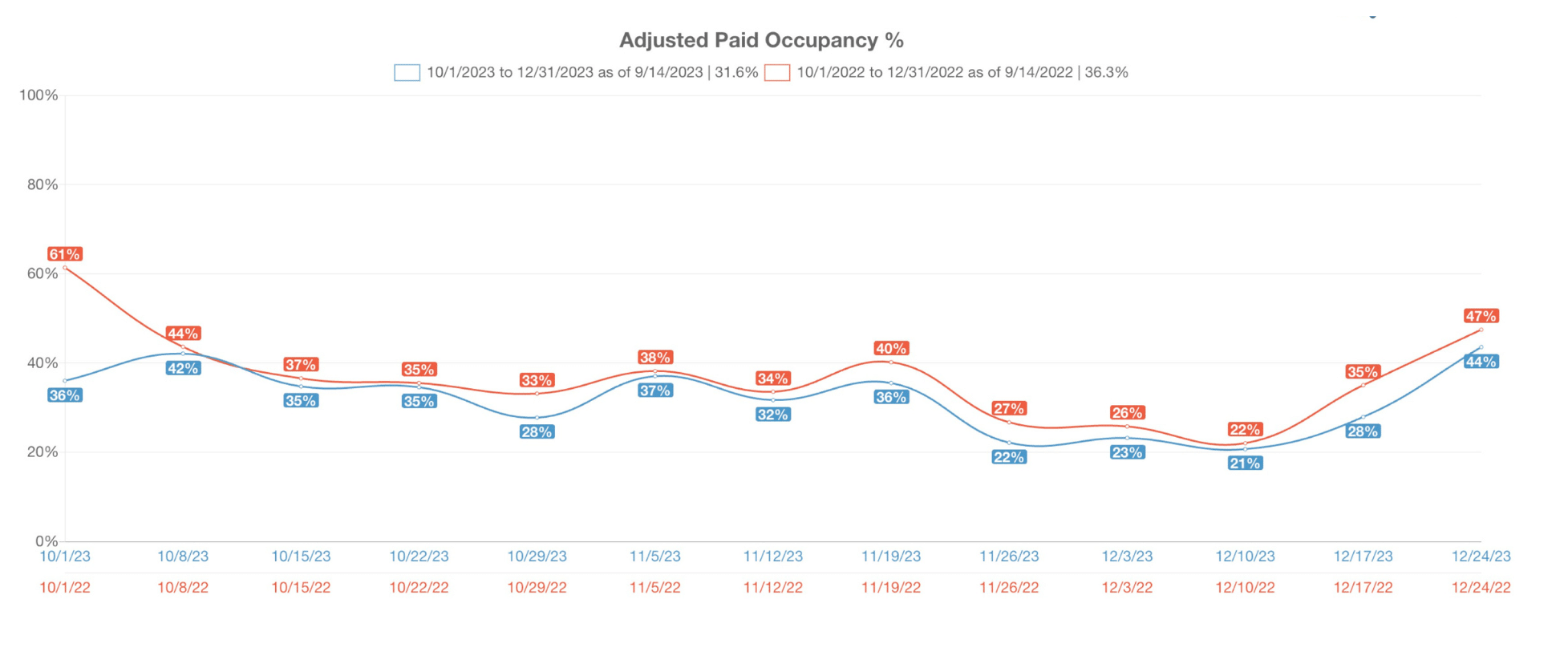

Advanced Pacing

Our industry is unique in that we get a glimpse into the future. Additionally, we can also compare current advanced booking metrics versus the same time last year (STLY). In doing so, we can see how the company is pacing and target specific areas to be further examined.

On a high level, STR business owners can track overall company financial health. Revenue managers can evaluate this data by segmenting into unit cohorts and even by individual unit (by bedroom, unit type, building, neighborhood, market, etc). Let’s say that pool-front condos are booking up faster than courtyard-facing condos… it might be wise to tick up ADRs on the pool-front units. The only way to know this information is if these KPIs are being tracked.

Another example: In April, a homeowner notices that their rental home has no summer reservations yet. They are concerned because last year at this time they had a full calendar. Breaking down advanced data into legible pieces will give you ammunition to discuss solutions or educate them on current market conditions.

>>> Macro-wise: Most companies are down YoY in aggregate advanced bookings due to occupancy decreases. However, as we are moving further away from the Covid bump, we are seeing slightly positive signs of a “bottoming out” in YoY trends

>>> Check out this KeyData article on how booking windows are affecting the short-term rental market

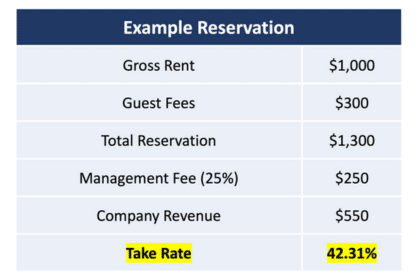

Take Rate

Another way to increase the value of your business is to diversify your revenue streams. This means charging for additional services, such as cleaning fees or damage insurance. These ancillary fees will contribute significantly to your vacation rental profit margin. A company’s take rate is the amount of revenue generated from the gross booking value. This metric is an important data point for analyzing the diversification of revenue. Unless your management fee is 40%-50%, it’s difficult to maintain profitability with only one source of revenue. The revenue from ancillary fees is generally almost equal to your management fee revenue (this is market specific and varies based on urban/leisure).

Many vacation rental companies consider the homeowner as their primary client. Your market has a finite number of homeowners, but a nearly infinite amount of guests. If you are going to err on the side of ancillary fees towards a customer, it’s generally best to lean towards guest facing fees.

Study the market and do a little “secret shopping” of your competitors. Keeping track of this annually keeps you competitive in the market:

- What percentage management fee do they charge?

- What does their homeowner rental contract look like?

- What additional reservation fees do they charge (per property type, static vs dynamic, length of stay, etc)?

>>> The average take rate is 35-45%, or slightly less than 2x your commissions

>>> Reach out if you’d like a template competitor-analysis spreadsheet

Operations

Short-term rental management is an operationally intensive industry. With multiple staffing departments each having specific software & communication needs, operations can quickly obscure the vision of the business. There are steps a business owner can take to get out of the “weeds” and lead the company’s mission. All in all, operational efficiency is key to saving both time and money, leading to an increase in your vacation rental profit margin.

Technology Stack

Technology is rapidly evolving in our industry, and it is easy to get caught chasing the next shiny toy. This can overload and even silo the staff. However, there are certain key software tools that are imperative for seamless operations & communication between staff, guests, and homeowners. Most, if not all, of your software should be integrated into your PMS along with unified inboxes. Jumping from software to software defeats the purpose of technology. If you are wondering what best-in-class softwares to use, talk with your property manager peers, not just vendors.

>> Check out Wheelhouse’s software vendor landscape

Brand

Your company brand encompasses your guest facing image, homeowner identity, and employee culture. Having a strong, cohesive brand unites your overall vision and ignites a sense of loyalty among clients & staff. Eventually, upon a sale, a strong company brand will bring more value to your company. This can be measured in direct bookings, reviews, NPS score, churn rates, google analytics, etc.

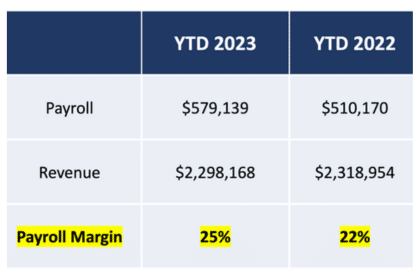

Staff

The short-term vacation rental industry is a labor-intensive operation with payroll being the largest expense. There are inflection points every couple of years in your businesses journey, where the choice is whether to remain stagnant, sell, or to invest in the future. If your answer is to invest, then you will take a step back in the short-term (financially), to take a leap forward for the long-term. Most vacation rental companies are small to medium-sized businesses (SMBs) and the company owners are normally intimately involved. However, a business is more valuable if the owner is in a leadership role. The most valuable delegated positions are the general operations manager and the homeowner liaison. It’s a critical growth initiative for the business owner to take a step back from those roles.

>>> The average industry payroll margin is 20% for companies with outsourced cleaners and 40% for companies with in-house cleaners.

Financials

Is it really all about the money? Yes, yes, it is. It is vital to have clear and precise financial statements that can easily tell the story of the business. If an advisor or investor needs a dynamic decoding device to decipher your financials, then it’s time to make change. Legible financials bring immediate value now and in the future.

COGS

Cost of Goods Sold are an often overlooked accounting section in the vacation rental industry. Recording direct costs of revenue allow for immediate and easy gross profit margin analysis. Each revenue account has direct costs, such as Processing Fee Income/Processing Fee Expense, Cleaning Fee Income/Cleaning Fee Expense, Maintenance Income/Maintenance Expense. COGS are an integral category on your profit and loss statements.

Know Your Margins

Everyone loves to look at profit margin, but profits are simply the result of revenues minus expenses. As we noted above, COGS are a clear path to review direct cost margins of revenue. These margins are only beneficial if they are consistently reviewed monthly, quarterly, and annually. If you are reviewing June numbers in December, the opportunity to make necessary changes has passed and money has been left on the table.

There are many valuable margins for a company to track. Key margins should be tracked for your major expenses vs company revenue.

>>> Company revenue is management fee income plus all guest & homeowner fee income. The homeowner’s portion of rent is not company revenue and should not be on your P&L

Financial Based Decisions

Most businesses exist to make money. A healthy business is a profitable business and a profitable business is valuable. Reviewing monthly financials immediately following the preceding month is crucial to making financial based decisions. If you are losing money on processing fees for every booking, it is likely time to reevaluate how that revenue is generated. If your payroll margins are increasing, you may want to review the efficiencies between departments. The only way to truly know your company’s financial health is to timely track your margins.

>>> Make sure your chart of accounts are set up properly in order to understand margins. There are great accounting firms that we are happy to recommend.

Ultimately, there are countless other criteria that can increase the value of your short-term rental business, such as quality of inventory, homeowner longevity, diverse revenue streams, direct booking percentage, SEO rankings, etc. Depending on the nuances of your business, some metrics are more easily attained than others. When growing your business, it’s advantageous to track clear & precise data points whether it’s financial KPIs, booking metrics, or operational synergies. These insights can contribute to enhancing your vacation rental profit margin and overall business value.

Want to learn more about how to increase the value of your short-term rental business? Reach out today!

Contact Us